We teach financial professionals how to support and communicate

with their clients in times of transition, crisis, and grief.

The Next Evolution in Advisor Education

We get it. This training is unique and the topic can feel a bit uncomfortable at first. But when have those on the leading edge of an industry ever just followed the pack down the easy path? You see, there are some fundamental truths about advising that most advisors simply do not realize. These truths are backed by overwhelming amounts of data. As the industry continues to evolve, there is a growing distinction between the advisors who "get this" and those who don't:

Click here to see the proof:

- 64% of affluent clients said the top reason for staying with their financial advisor is the relationship with their advisor, far outpacing the 30% who felt positive investment performance was most important. – Merrill Lynch

- 67% of Gen YZ clients want an advisor who “provides services beyond financial advice and investment management.” – Fidelity Investments

- “Deep Understanding of Me and My Goals” is the top criteria in determining client’s overall satisfaction with their advisor, beating out both “Portfolio Performance” and “Financial Advice Given.” – YCharts

- 82% of clients rank "Interpersonal skills" as one of the most important qualities in their advisor. The next most selected is “Professional reputation” at only 19%. – Association of Financial Advisors

- Clients rank "Deep understanding of me and my goals" and "Customer service/communication" as the two most important factors when selecting a financial advisor, above both "Portfolio performance" and "Financial planning capabilities." – YCharts

- Clients ranked “Trustworthy” and “Someone who listens” above both “Good performance record” and “Expert in his/her area” when asked the most important considerations for selecting a financial advisor. – CFP Board

- Clients rank “Trusted” as being the most important quality when selecting their financial advisor. – Qualtrics

- 53% of clients listed the Emotional component as the most important contributor towards trust in their advisory relationship, over both Ethical (2nd) and Functional (3rd) considerations. – Vanguard

- 79% of clients said that “personalized communication with their financial advisor would boost confidence in their advisor, greater retention of their advisor’s services, and an increased likelihood of recommending their advisor’s services to family members or friends.” – YCharts

- 64% of clients say that being skilled in Psychology of Financial Planning is an extremely important or very important quality in their financial advisor. – CFP Board

- 85% of advisors say that they consider frequency and style of communication when deciding to retain a financial advisor. – YCharts

Click here to see the proof:

- 75% of clients switched or considered switching advisors in 2023, a dramatic 27% increase from previous years. – YCharts

- More than 70% of heirs are likely to fire or change financial advisors after inheriting their parents' wealth. – Cerulli

- 70% of widows switch financial advisors after their husband’s death. – Spectrem Group

- 32% of advisors report losing divorced women after the divorce. – TIAA-CREF

- “Advisor neglected relationship” is the most common reason clients gave for switching advisors, particularly among high and ultra-high net worth clients. – Vanguard

- Two of the Top 3 reasons for switching financial advisors are “Poor customer service” and “Lack of personalized attention,” along with “High fees.” – Qualtrics

- Clients who highly trust their advisors are more than twice as likely to refer them as those who have more modest levels of trust. – Vanguard

- 64% of clients who consider their their advisor a friend gave three or more referrals in 2022, compared to only 35% who don't consider their advisor a friend. – Oechsli

- 58% of high net-worth investors have switched advisors at least once in their lives – Spectrem Group

Here's the proof:

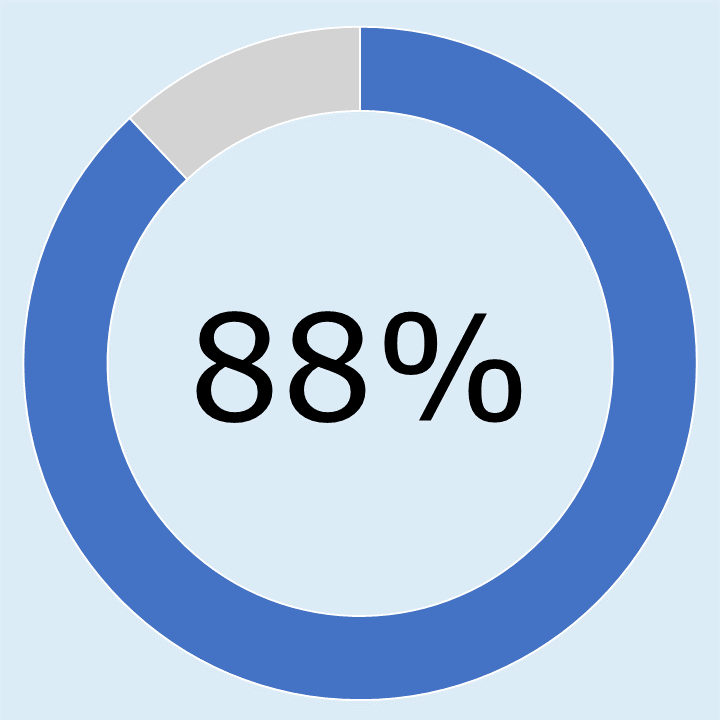

In a follow-up survey of attendees of Corgenius training:

said Corgenius training had a definitive impact

on their ability to retain current clients.

on their ability to acquire new clients.

more valuable than other instruction they had

received on client communication and relationships.

Distinguish Yourself from Other Advisors

If you can walk clients through the toughest times of their lives, you'll have clients for life.

Truly Unique Training

Keynotes &

Advisor Training

Bring distinctive, value-add instruction to your event or office. Amy works with you to craft the perfect session, and all content is eligible for CE credits.

Client Sessions

Make a lasting impression by offering inspiring, comforting, informative sessions directly to your clients. Amy will touch their hearts through her compassionate communication.

Video Training

For the first time, Amy's complete 18-hour training will be available to individuals. Learn the same proven skills and insights that firms have relied on for years - at your own pace, on your own schedule.

From Amy's Attendees

Books & Resources

The definitive guidebook for professionals serving clients through life transition.

The definitive guidebook for professionals serving clients through life transition.

- U.S. News 2021 – The 15 Best Finance Books for Financial Professionals

- C-Suite Book Club – Recommended for C-level Professionals

- Financial Planning Magazine – 2015 Top Ten List of Summer Reading for Financial Advisors

- 2016 Best Book Awards – Finalist in Business category

- 2016 Axiom Business Books Awards – Silver in Business Reference category

Also from Amy

12-page booklet of just-in-time refreshers of effective and compassionate things to say (and not say) when clients navigate life transitions.

International award-winning book for your clients that teaches them how to support their loved ones, while also gaining insight and reassurance about their own grief.